How to Get Insurance to Pay for Water Damages

We understand the stress and confusion of navigating the insurance claim process. This guide provides comprehensive information on maximizing your water damage claim and getting your insurance to pay for water damages as well as the average cost of water damage repairs and comon causes. Water damage can be a homeowner's worst nightmare, especially in Utah's diverse climate. The aftermath can be devastating, whether it's a burst pipe, a severe storm, or a leaky roof.

Understanding Your Insurance Policy

Understanding your policy is the first step in getting your insurance to pay for water damages. Not all insurance policies are created equal, and the coverage can vary significantly. Most standard homeowners' insurance policies cover sudden and accidental water damage, like broken pipes or water damage in floors and subfloors. However, damages from floods or lack of maintenance might not be covered. Reviewing your policy thoroughly and consulting with your insurance agent to clarify any uncertainties is crucial.

Filing a Water Damage Claim:

Once you've determined that your insurance policy covers the water damage, the next step is to file a claim. Here's a step-by-step guide on how to do it:

Document the Damage: Take detailed photos and videos of the damaged areas. This will serve as proof when you're filing your claim.

Contact Your Insurance Company: Notify your insurance company about the damage immediately. They will guide you through the claim process.

Fill Out Claim Forms: Your insurance company will provide claim forms. Could you fill them out accurately and completely?

Meet with the Adjuster: An insurance adjuster will visit your home to assess the damage. Be present during this visit to answer any questions they might have.

Review Settlement: The insurance company will provide a settlement based on the adjuster's report. Please review it carefully to ensure it covers all your losses.

Maximizing Your Water Damage Claim:

The question, how to maximize water damage claim, often arises among homeowners dealing with water damage. Here are some tips:

Document Everything: Document everything from the damage to all communication with your insurance company. This will help you in case of any disputes.

Get estimates: Get Professional estimates from professional water damage restoration companies such as Uinta Disaster Solutions. This can help you negotiate a better settlement.

Be Patient: Insurance companies can take time to process claims. Be patient and persistent.

Common Causes of Water Damage:

Water damage can occur for various reasons, each with unique challenges. Some of the most common causes include:

Leaking Pipes: Over time, pipes can corrode, leading to leaks that can cause significant water damage if not addressed promptly. This is especially common in older homes where the plumbing system hasn't been updated for many years. Leaks can occur anywhere in the home, but they're particularly prevalent in areas with high water usage, such as kitchens and bathrooms.

Burst Pipes: Extreme cold can cause pipes to freeze and burst, leading to sudden and extensive water damage. The water inside the pipes expands when it freezes, increasing the pressure inside the pipe, which can lead to bursting. This is a common issue in colder climates or during winter months.

Appliances and HVAC Issues: Overflows or leaks from appliances like washing machines, dishwashers, and water heaters can cause sever water damage to sub-flooring if not treated quickly. As these appliances age, their pipes can rust, and hoses can weaken, leading to leaks or bursts. Similarly, HVAC units can cause moisture buildup, leading to mold and water damage over time. This is often due to issues like condensation leaks in your air conditioner.

Natural Disasters: Natural disasters like storms and floods can cause severe water damage. Heavy rains can lead to flooding, especially if your home is in a low-lying area. Similarly, hurricanes and storms can cause water damage from both flooding and wind-driven rain.

Roof Leaks: Damaged or old roofs can leak, causing water damage to ceilings and walls. This can be due to various reasons, including missing or damaged shingles, cracked flashing, or an improperly installed skylight. Water typically travels along your roof panels, causing damage far away from the original leak, making roof leaks particularly difficult to diagnose and repair.

Average prices for water damage repairs

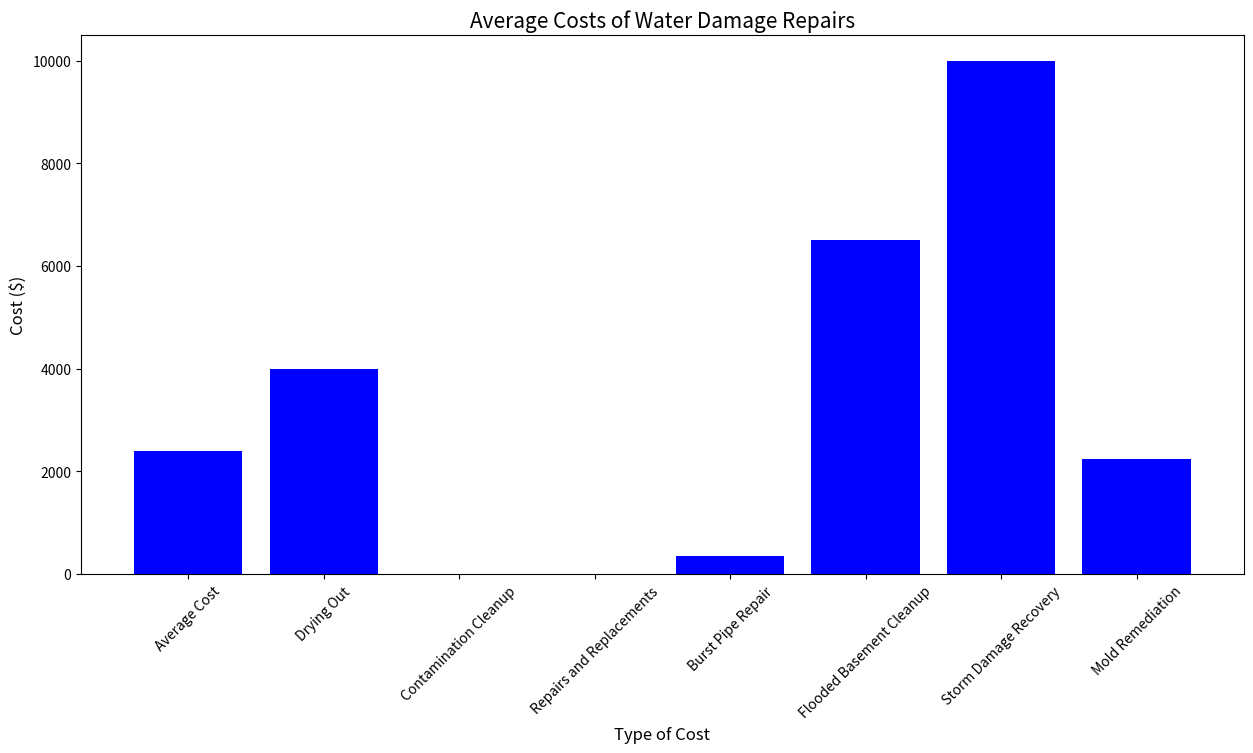

The graph shows the following cost for Water Damage

The Average Cost of Water Damage repair is approximately $2,400. This cost covers the expenses associated with mitigating the damage caused by water intrusion.

Drying Out: This is the average cost of drying out your home and repairing the damage done by the water, which is around $4,000.

Contamination Cleanup: This is the cost per square foot for cleanup if the water contains bacteria and sewage, which is around $7.

Repairs and Replacements: This is the cost per square foot for repairs and replacements after contamination cleanup, which is also around $7.

Burst Pipe Repair: This is the average cost of repairing a burst pipe, which is around $350.

Flooded Basement Cleanup: This is the average cost of cleaning up a flooded basement, which is around $6,500.

Storm Damage Recovery: This is the average cost of recovering from storm damage, which is around $10,000.

Mold Remediation: This is the average cost of remediating mold, which is around $2,250.

Please note that these costs are averages and actual costs can vary based on the extent of the damage, the cause of the water damage, and the specific rates of the professionals hired to perform the repairs.

Understanding how to get insurance to pay for water damage can alleviate some of the stress associated with water damage. The key is understanding your policy, documenting the damage, and filing a thorough claim. While it's possible to undertake some repairs, hiring professionals can ensure the job is done right. At Uinta Disaster Solutions, we help Utah homeowners navigate the aftermath of water damage, from restoration to insurance claims. Contact us today for more information.

Insurance laws are crucial in covering various damages, including water damage. Understanding these laws is essential for homeowners and business owners to ensure appropriate insurance coverage against potential water damage incidents. In the event of water damage, policyholders must be familiar with their rights and obligations under their insurance policies and the applicable laws. For comprehensive information on insurance laws and water damage claims, individuals can refer to the official website of the National Association of Insurance Commissioners. The NAIC website offers valuable resources and guidelines on filing water damage claims, understanding coverage limitations, and handling insurance disputes. By accessing the NAIC's website, policyholders can gain insights into the insurance claims process, learn about their rights, and access tools to help them navigate water damage claims effectively.